Tax preparation is one of the most demanding and stressful tasks which the business owners have to face during the busy fiscal year. As per a report by YouGov, Americans who use tax preparation software for filing their taxes account for more than 22%, along with being the ones who save more time and money in preparing uncomplicated tax returns.

It is imperative that financial management is taken care of in the best manner throughout the year as this makes up for an error-free or error-full tax preparation in the future. The task of preparing the taxes demands time, efforts, and expertise, with most of the business owners are always missing out on one or all of these elements.

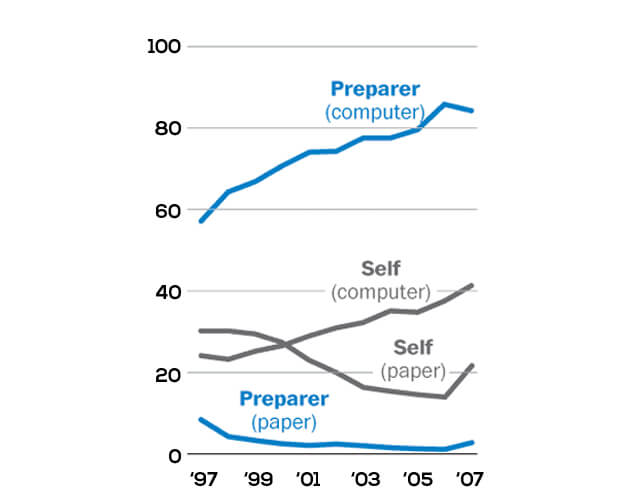

Number of taxpayers and methods used for filing (in millions)

Image Source: Finances Online

An estimated number of 127,939,000 tax returns for the 2018 tax year were e-filed, reports IRS. Also, 56,214,000 taxpayers constitute of the self-prepared list who had their federal tax returns e-filed as of May 2019.

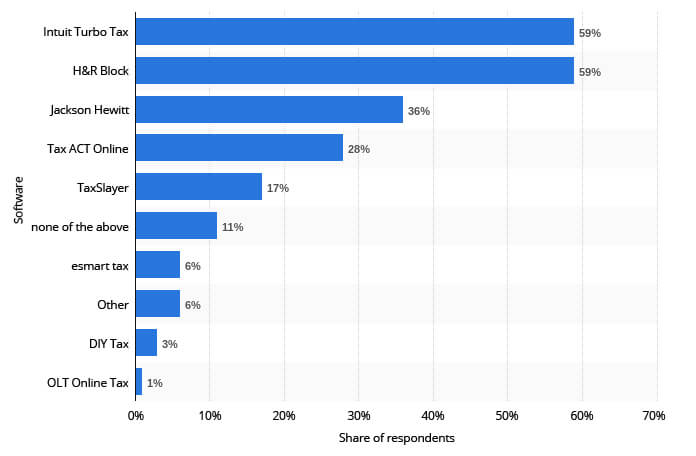

A survey carried out on 843 American about which software product they know for filing taxes:

Image Source: Statista

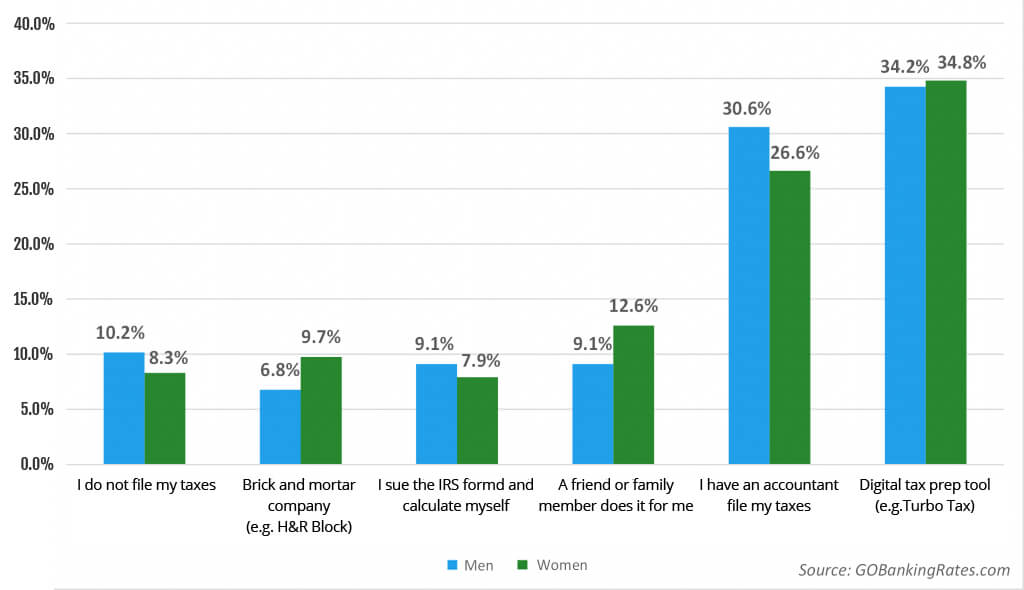

Gender Insights: How Do Americans File Their Taxes?

Top 10 Tax Preparation Software

The only way to efficiently deal with tax preparation is by adopting the use of the following tax filing software, which eliminates the need for excessive human efforts and provides maximum aid during tax preparation.

10. UltraTax CS Software

UltraTax CS Software is an apt choice when it comes to having a software program which provides full-featured professional help. It offers extensive diagnostics, on-screen access for tax reference material and help, and keyboard shortcuts. In the CS Professional Suite, it integrates with Accounting CS and other software, with the following features adding to user convenience

- On-screen reference material and help

- Diagnostics for errors

- Shortcuts for keyboard

- UltraTax CS Software Customer support

- CS Professional Suite programs integration

| Official Website | https://tax.thomsonreuters.com/us/en/cs-professional-suite/ultratax-cs |

| Founded | 2008 |

| Developers | Thomson Reuters Corporation |

9. ProSeries Professional Software

ProSeries Professional Software lets you import data from QuickBooks and Quicken, unlike CCH Axcess, along with the option of importing income data of investment from monetary organizations. The following features make this one of the most in-demand tax preparation software for CPA

- Import data from QuickBooks, Quicken, and TXF files

- Scanned tax forms for importing data

- Utility built-in for scheduling

- Clients collaboration via SmartVault or Intuit Link

- DocuSign for electronic signatures

- ProSeries Professional Software Customer support

| Official Website | https://proconnect.intuit.com/proseries/ |

| Founded | 1983 |

| Developers | Intuit Inc. |

8. Drake Software

Drake Software lets accountants make any tax return type in one package. It has a nice in-software and diagnostics access to help the users, along with the following features.

- Any type of tax return preparation

- Convenient keyboard shortcuts

- Simple diagnostics

- Quick help features

- Drake software customer support

| Official Website | https://www.drakesoftware.com/ |

| Founded | 1977 |

| Developers | Drake Software |

7. Lacerte Software

With a worksheet-based interface for data entry, Lacerte Software makes the processing of data quick and convenient. Lacerte Software also constitutes of data import keyboard shortcuts, tools, extensive diagnostics, on-screen help, and the following features.

- Import data after downloading for Schedule D and Forms W-2

- Help through F1

- Online knowledge base access through the search box

- Integration of QuickBooks

- Alike exchange wizard

- Electronic organizer

- Office tools Practice Management software integration

| Official Website | https://proconnect.intuit.com/lacerte/ |

| Founded | 1998 |

| Developers | Intuit Inc. |

6. TaxSlayer Software

TaxSlayer Software was solely intended for the use of tax professionals only, but eventually got upgraded for individual return preparation. It is a cloud-based software which lets you access it from any part of the world.

With the help of ‘Quick File’, one can read anything by simply entering a keyword and not hunt all the links. The database for searchable information is built exactly the way tax professionals would want, with ‘error checker’ topping the list in the TaxSlayer Software conveniences.

| Official Website | https://www.taxslayerpro.com/ |

| Founded | 1965 |

| Developers | TaxSlayer LLC |

5. Credit Karma Software

The initial users of Credit Karma Software had issues with the help functions and handholdings but its upgraded version fixed these issues, along with introducing Chat help and a ‘help’ database which helps you to search as per your query.

Also, Credit Karma Software is not limited to 1040A and 1040EZ returns only, but capable enough in handling all the major IRS forms and schedules, especially when it comes to more complex tax situations.

| Official Website | https://www.creditkarma.com |

| Founded | March 8, 2007 |

| Developers | Credit Karma |

4. eSmart Tax Software

Most of the businesses are looking for accounting software which provides simplicity and is also cost-effective at the same time, and this is what exactly eSmart Tax Software offers. Users are able to navigate from deductions to income in no time and that too effortlessly.

A list is available for the users through which they can choose the most relevant tax related information for them. The ‘user instruction articles’ in the eSmart Tax Software helps in navigating through the software, which helps a lot during the initial usage phase.

| Official Website | https://www.esmarttax.com/ |

| Founded | 1997 |

| Developers | Liberty Tax |

3. TaxAct Software

The investment income and self-employment returns can be best handled using TaxAct Software. The Life Events feature lets you know about the changes in your tax returns within a period of one year, with 19 icons that might or might not relate to your current situation.

In the TaxAct Software, you also get to enjoy the live customer support and hyperlinked phrases and words that let you have additional information and explanations, making it one of the best tax software for tax preparers.

| Official Website | https://www.taxact.com/ |

| Founded | 1998 |

| Developers | TaxAct Holdings, Inc. |

2. H&R Block Tax Software

H&R Block Tax Software is a very friendly software which asks questions and deciphers answers at the time of your tax preparation. Users can also gain access to the live professional advice for tax preparation through the Help window. If you pay extra, you can have an expert to review your return before you file it.

H&R Block Tax Software is considered to be one of the best when it comes to handholding, along with providing a “tax prep checklist”, to let you know about the documents required during tax preparation.

| Official Website | https://www.hrblock.com/tax-software/ |

| Founded | January 25, 1955 |

| Developers | HRBlock |

1. TurboTax Software

If you are looking for a personal tax preparation software, TurboTax Software is recommended greatly. Its ‘expense finder’ feature helps in lifting the expenditures which are tax-deductible from the bank and input them after categorizing and adding.

One can easily get to know the qualification for various credits and tax deduction by merely entering the personal details. Apart from this, the ‘SmartLook’ feature of the TurboTax Software lets you have a tax expert for audit assistance.

| Official Website | https://turbotax.intuit.com/ |

| Founded | 2001 |

| Developers | Intuit, Inc. |

Conclusion

It is imperative that the businesses move with the latest technological trends to prepare the tax returns and incorporate the use of the above-listed professional tax preparation software. Depending on the budget and tax preparation requirements, owners should choose the most convenient software for their businesses.

The use of software not only lowers human efforts but also, boosts work productivity by speeding up the tax preparation process and eliminating the scope of any manual error.

Read Also: What Accounting Software CPAs/Accountants Use and Why?